<-

Back to all articles

B2B, Saas, Market Analysis

The 20 most promising B2B SaaS companies

Aug 19, 2024

B2B SaaS continues to be one of the most consistent sectors for investment and growth. Valued at $327.4 billion in 2023, it's projected to reach a staggering $1 trillion by 2030.

But with over 30,000 SaaS companies worldwide, identifying the most promising investment targets can be challenging. How do you spot the startups that are not just innovative but also likely to seek funding soon?

We've tackled this question head-on. Using our real-time dataset, we've analyzed key indicators such as quarter-over-quarter headcount growth and time since the last funding round among others.

The result? A curated list of 20 B2B SaaS startups that show strong potential for seeking investment in the near future.

Here's our top 20 list of B2B SaaS companies to watch in 2024:

Finkraft: FinTech

SentraWorld: EnviroTech

Nexxio: Enterprise Software

Munch Software: Restaurant Technology

Oleria: Cybersecurity

Unique AG: FinTech/AI

TransBnk: FinTech

Chelpis Quantum Tech: Cybersecurity/Quantum Technology

Cross4Cloud: Cloud Management

Basis Theory: FinTech

Flip CX: Customer Service

Spendbase: SaaS/Expense Management

Lemurian Labs: AI Technology

AtomicWorks: IT Service Management

Bluecopa: FinTech

Impactsure: AI/Document Processing

cQuant.io: Energy Analytics

Shelvz: Field Force Management

Alpas: Procurement Technology

Corsha: Cybersecurity

If you want the full descriptions for these startups check it out here.

Why these startups caught our attention

The average time since their last funding round is 16 months, suggesting they may be preparing for their next raise.

Their median quarterly headcount growth is an impressive 22%, indicating money is being spent and growth is continuing.

Let’s take a deeper look into these startups

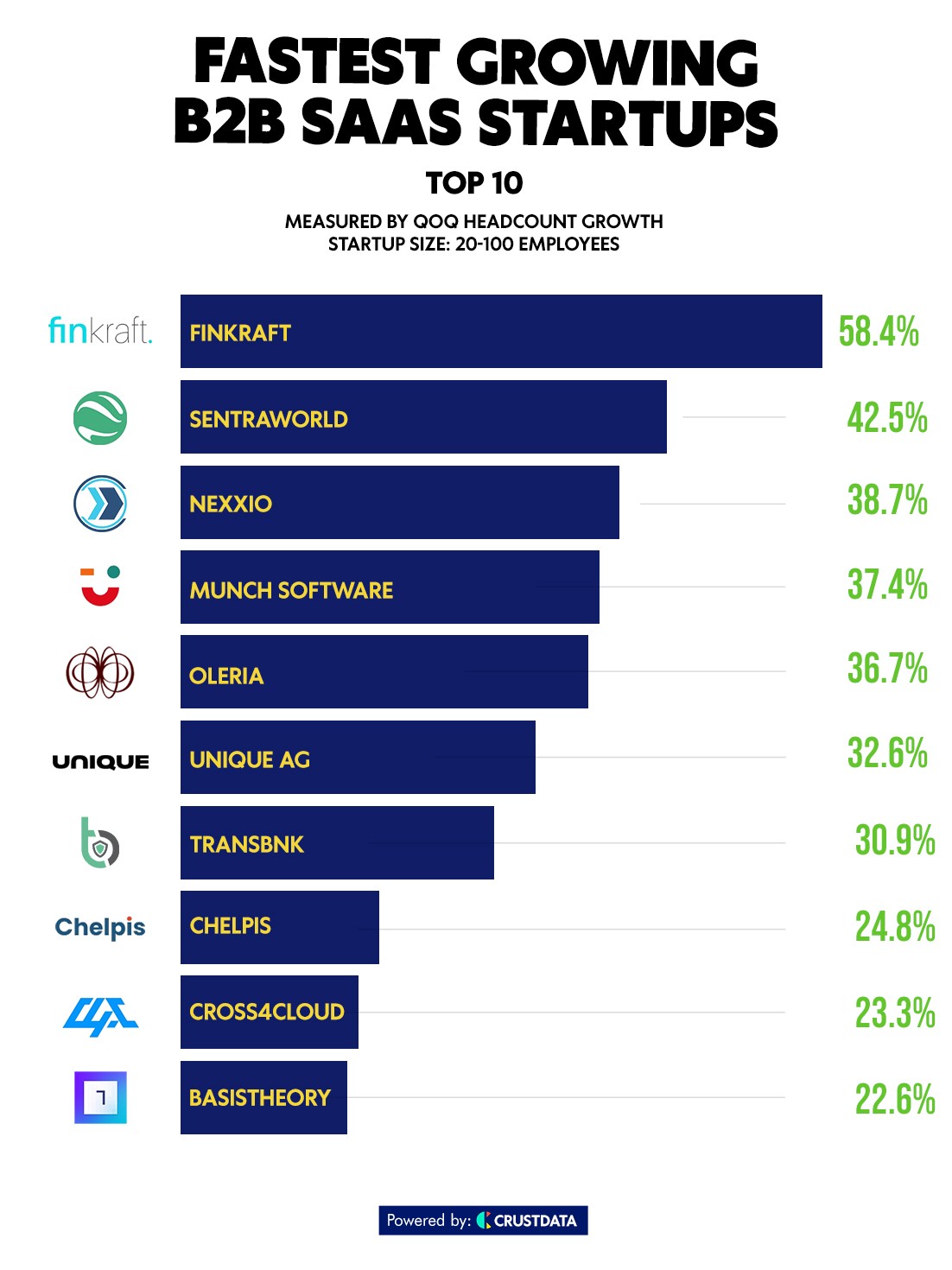

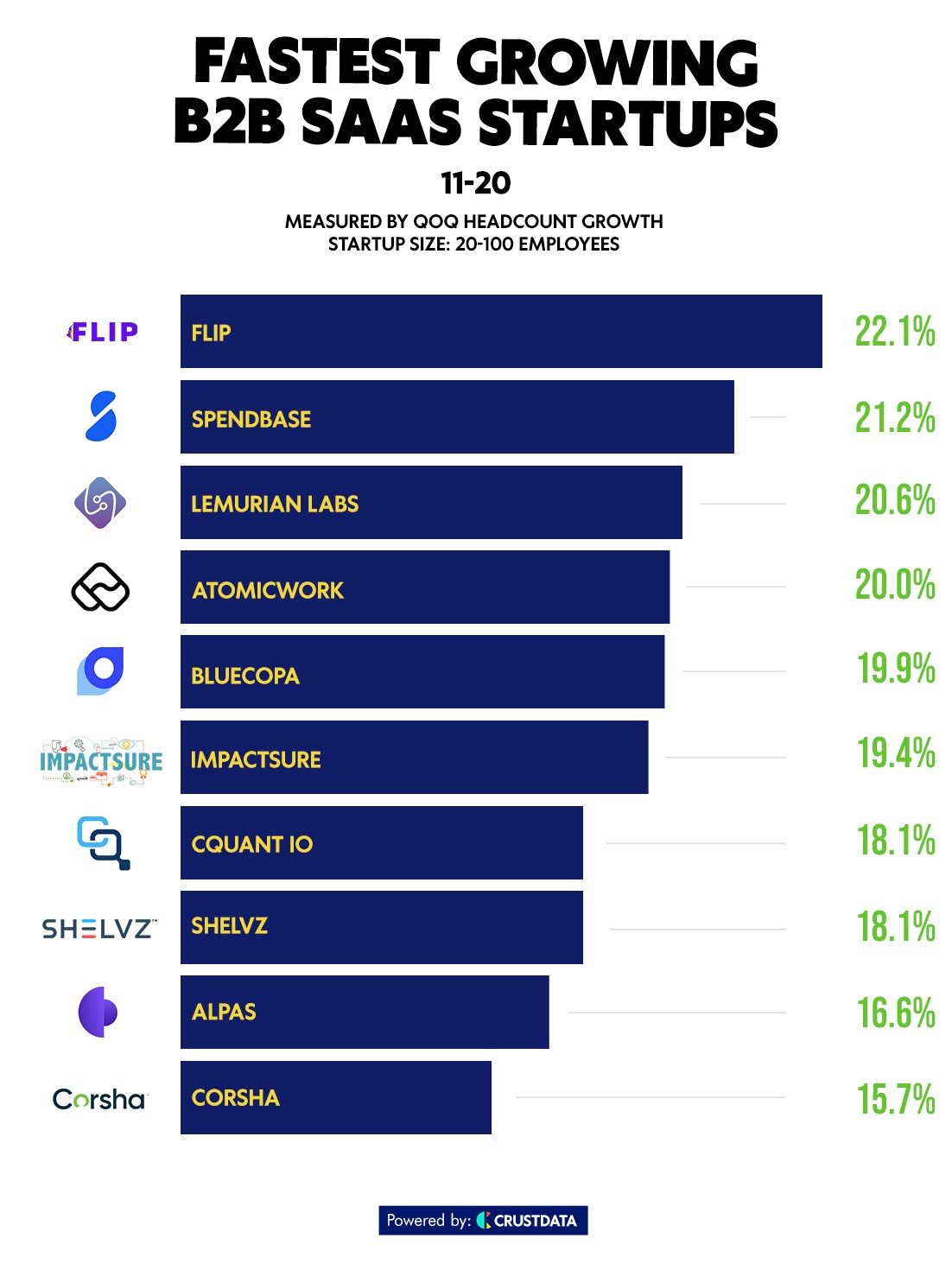

Fastest Growing Startups

The fastest-growing B2B SaaS startups span diverse sectors, from FinTech, EnviroTech to Cloud management and more. Companies delivering cost-saving solutions through automation and data analytics such as Finkraft and SentraWorld, are experiencing the most rapid growth.

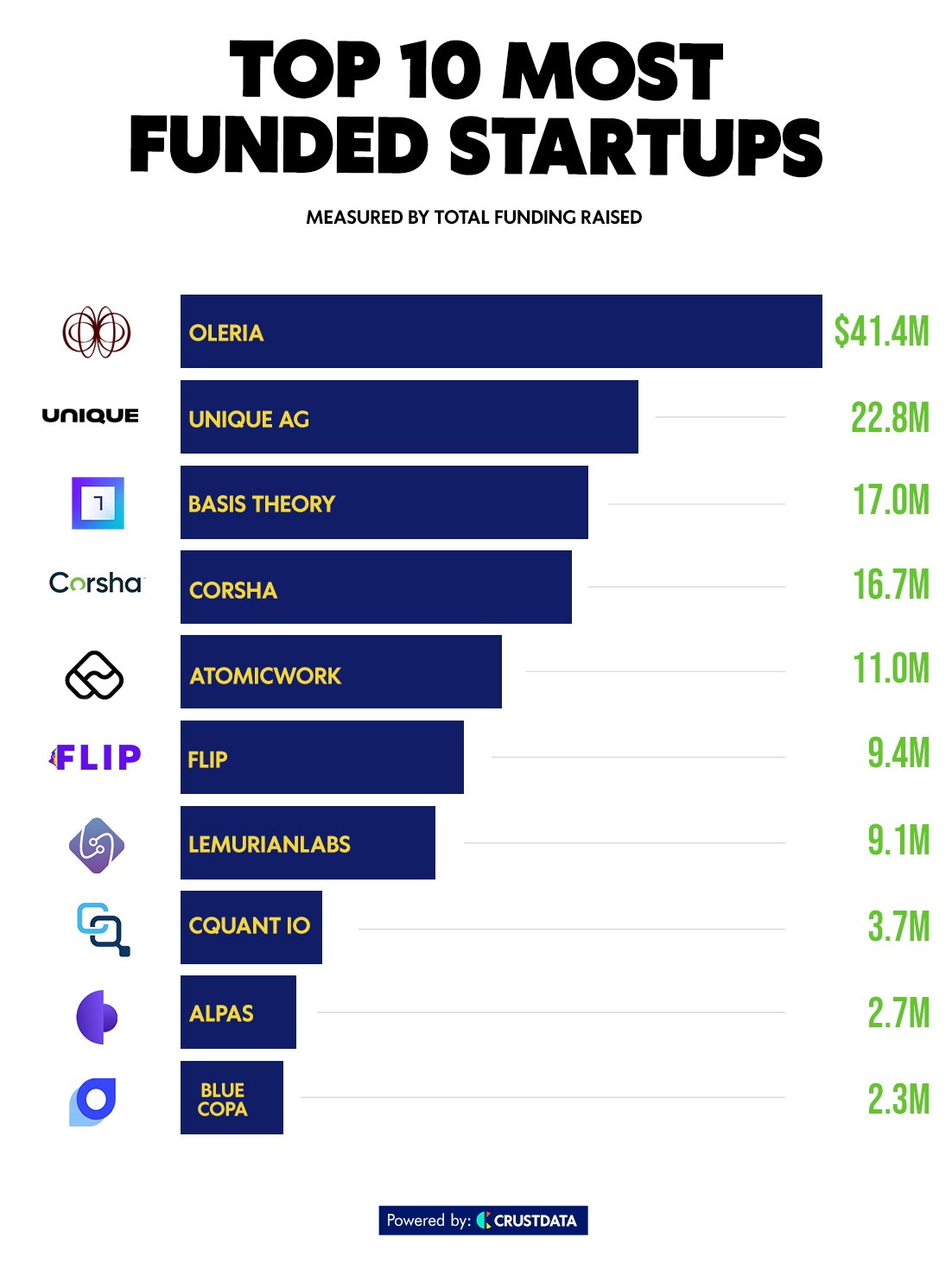

Most Funded

Oleria, a cybersecurity startup tops the list.

The startup provides identity security solutions for enterprises. They offer detailed visibility into access patterns, including who has access to what resources, how they obtained access, and how they're using it. This helps organizations better manage and secure their digital identities.

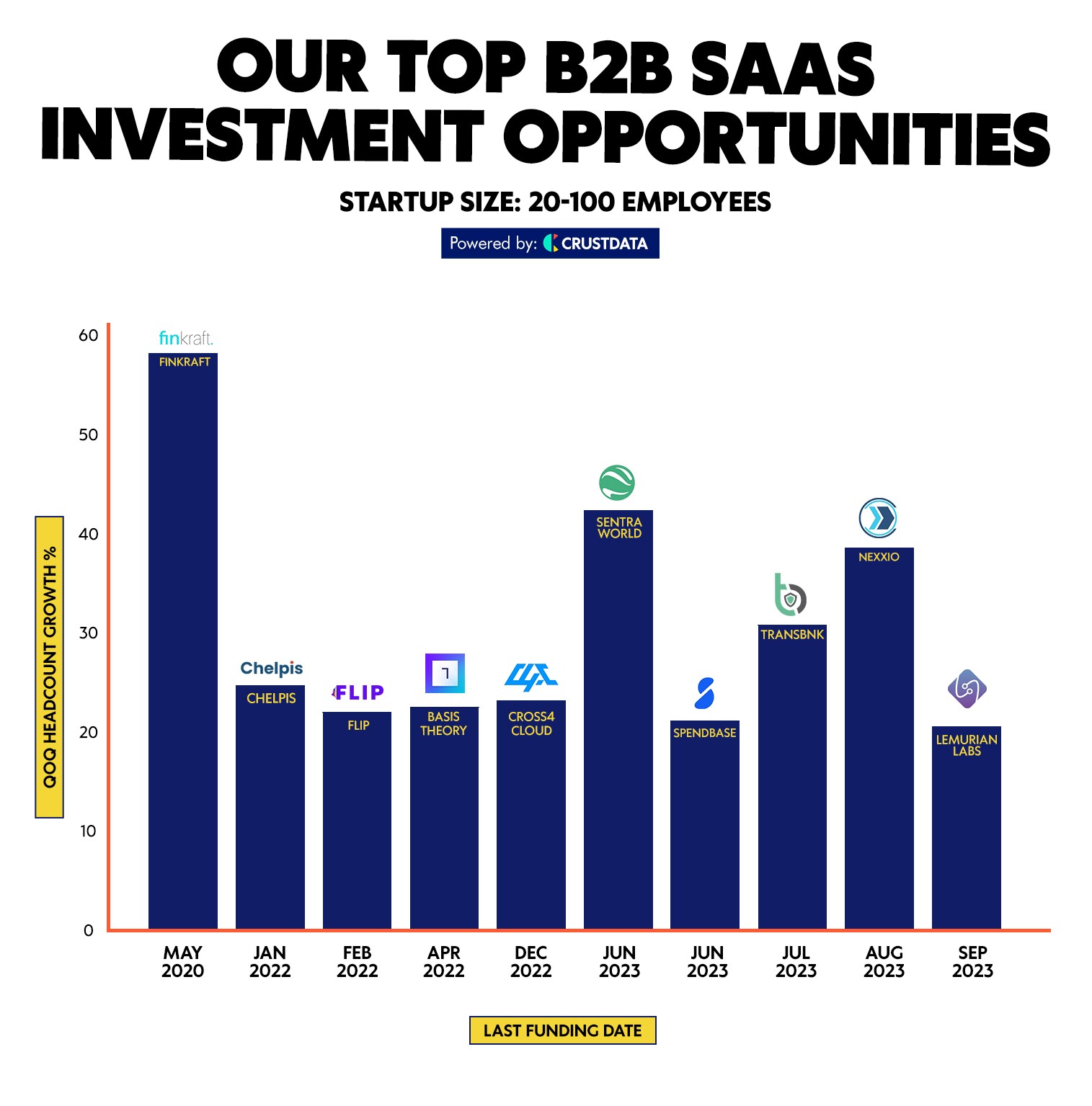

Our Top Picks

We’ve also curated a top 10 list that shows the startups that might be looking to raise funds soon.

Finkraft, a FinTech company that automates complex business processes, focusing on GST credit management for corporate clients increases its team by more than 50% each quarter!

Here’s a brief description of our other top picks:

Chelpis Quantum Tech: Develops post-quantum cryptographic technology to protect against future quantum computing threats.

Flip CX:Automates phone support with an Alexa-like experience, helping brands manage customer service at scale.

Basis Theory: Offers a programmable vault for businesses to build customized payment infrastructures and manage compliance.

Cross4Cloud: Provides a unified API for managing multi-cloud services across major providers, simplifying cloud management.

SentraWorld: Provides AI-powered carbon accounting software for industrial businesses to measure and reduce emissions.

Spendbase: Provides a SaaS platform for IT and finance teams to optimize corporate software usage and spending.

TransBnk: Offers a transaction banking platform for corporate clients, enabling secure and efficient business transactions.

Nexxio: Offers a B2B SaaS platform to digitize and optimize sales and distribution for consumer goods companies.

Lemurian Labs: Develops advanced AI hardware and software solutions for next-generation computing and artificial intelligence.

B2B SaaS remains one of the hottest areas of growth.

We hope this list helps you find the next breakout stars in this space.

About the data

The data seen above is from Crustdata - the most accurate realtime LinkedIn data source for growth and private equity investors. It indexes billions of public data points on companies every week to provide an edge over the private market.